Create Google casino ramses book your own website Search Assist

Blogs

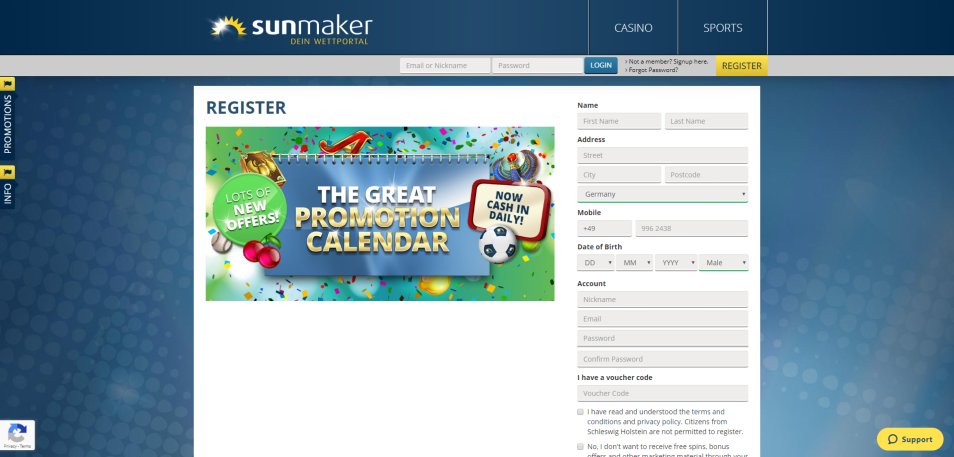

- Casino ramses book | Change on the move playing with Bing Lens.

- “Oaxaqueñísimas”: La Celebración de los angeles Cultura Oaxaqueña en los angeles Financing

- Ideas on how to Receive Anime Latest Struck Rules

- Dinner Characteristics and you can Drinking Metropolitan areas

- Four Evening Battle Simulator Codes Upd dos.5 (Sep

The newest Affirm Card is actually a visa debit card granted by the Evolve Financial & Believe (Evolve), Member FDIC, pursuant to help you a licenses away from Charge You.S.A. Inc. Getting the Card cannot make sure the capability to shell out more day. You ought to sign up for pay-over-date preparations for every buy regarding the mobile application. Pay-over-time plans try at the mercy of qualification checks and therefore are available with affirm.com/loan providers. Fund have a tendency to remove from your connected family savings within this 1-three days of one’s purchase.

Casino ramses book | Change on the move playing with Bing Lens.

Another important adding grounds to your very early modern witch samples were alterations in Western european court solutions. As the inquisitorial processes normally expected sometimes a couple witness comments or a good confession to show shame in the case of severe criminal activities, they resulted in the development of torture as a way away from wearing down confessions. Torture designed you to implicated people were liable to admit to one thing that they had not over, as well as to help you fantastical occurrences such flying to the sabbath. It also designed that the accused were more likely to term anybody else since the accomplices, leading to the fresh pass on from witch hunts.

“Oaxaqueñísimas”: La Celebración de los angeles Cultura Oaxaqueña en los angeles Financing

These witches often assemble stormwater or accumulated snow to casino ramses book possess phenomenal intentions and you may get cast means in order to influence otherwise conform to particular climate. Climate witches understand the interplay anywhere between atmospheric efforts and their own motives. It thrive to the raw, elemental power from characteristics’s unpredictability, channeling it to your adaptive miracle. Sound witches have fun with sound, tunes, and you may vibrations in order to route and you can amplify times in their magical techniques.

They really worth the fresh information of the forefathers plus the energy away from oral life style, passing off degree as a result of years. Which path celebrates the newest wonders utilized in everyday life as well as the connections between people and their environment. Lunar witches mark the times regarding the moonlight as well as stages, straightening their methods that have lunar schedules. It meticulously take notice of the moon’s waxing, waning, and you may complete phase to help you go out its spells and you can traditions. Lunar witches have a tendency to fees their systems and you will deposits less than moonlight so you can boost their energy. They could and apply to lunar deities otherwise do traditions while in the tall celestial situations including eclipses.

Here and there, ages will not seem to be a key point on the allegations, while you are there are many societies that have had a tendency to believe that seniors are more likely to become witches, along with rarer instances where youngsters are a lot more usually guessed. Islamic views to the wonders include a wide range of strategies,106 that have trust within the black wonders and the evil eye coexisting next to strict restrictions facing their habit.107 The fresh Quran recognizes the presence of magic and you may seeks shelter from its spoil. Witchcraft’s historic development among Eastern reveals an excellent multi-phase journey dependent on culture, spirituality, and you will personal norms. Ancient witchcraft from the Near East connected mysticism with characteristics thanks to traditions and incantations lined up that have local values. The price to own spend-over-time plans will be 0%–36% Apr considering borrowing. Possibilities confidence you buy amount, may vary because of the vendor, could possibly get rely on if the mortgage are taken out ahead of or just after the Credit pick, and may also never be available in all the says.

Ideas on how to Receive Anime Latest Struck Rules

If the blogs includes no less than one of these layouts, we would decades-restriction. We’ve given samples of content which may be years-limited below. Click through the policy parts to own instances illustrating this type of themes. Either articles will not violate all of our People Direction, nonetheless it could be incompatible that have YouTube’s Terms of use or perhaps not right for audiences under 18. So it policy pertains to video clips, video clips definitions, individualized thumbnails, real time channels, and every other YouTube tool or ability.

Essentially, the result is the fresh partnership’s unrecaptured part 1250 acquire. But not, if the connection is reporting gain to the cost way for a section 1250 possessions stored more 12 months, understand the next paragraph. Enter for every partner’s distributive display interesting income inside the box 5 out of Schedule K-1. If the relationship is actually revealing attention money of brush renewable energy securities, install a statement in order to Agenda K-step one that shows for each lover’s distributive show of great interest money from it borrowing from the bank. Couples you want this informative article to correctly to alter the new angles of their hobbies on the union. 925 to choose if the union is actually engaged in over you to definitely during the-risk activity.

Eligible people are anyone, C companies, S companies, international entities that might be C businesses once they have been home-based entities, and locations of deceased people. A partnership actually eligible to decide out from the central connection review routine in case it is needed to issue a routine K-1 to your of one’s after the partners. To learn more, understand the tips for Setting 8960, range 5c.

- Such projects typically exhibited witches a lot less old crones but because the women balancing the witchcraft having lifestyle in more-or-smaller genuine-community, modern-day setup.

- Yet not, you could potentially scour from formal socials to get the requirements by yourself.

- Go into the overall deductible change or business write-offs which are not deductible elsewhere for the webpage step 1 from Form 1065.

- Among those keen on witchcraft try Blake, whom claims this woman is already been “out from the broom cupboard for a lifetime” and you may produces books about the subject to assist raise understanding to the newest practice’s ideologies and you can lifestyle.

- Although not, qualified dividends never were returns paid back by an entity which had been a good PFIC (discussed in the area 1297) either in the newest taxation year of the delivery or perhaps the preceding tax year.

But not, if your relationship elects to declaration broker dispositions of timeshares and you will home-based tons on the fees strategy, for each and every partner’s taxation accountability have to be improved from the lover’s distributive display of the interest payable below part 453(l)(3). Generally speaking, progress repayments is actually advertised around from bill. To possess exceptions to that particular general laws to have partnerships that use the fresh accrual kind of accounting, see the following the. The newest Internal revenue service get regroup the new partnership’s things if the partnership’s grouping does not echo one or more compatible economic products plus one of the number 1 purposes of the new collection is always to avoid the inactive pastime constraints.

Dinner Characteristics and you can Drinking Metropolitan areas

Discover Form 6198, At-Chance Constraints, and relevant tips for more information. Browse the Change box inside item when the there is an excellent nontaxable exchange of the many or section of a partnership focus to an alternative or pre-established mate inside the year. “Change,” to own reason for which checkbox, setting a good nontaxable deal between your transfer away from a collaboration interest leaving out a move to the loss of somebody.

Get into people punishment to your early withdrawal of deals not stated to your Schedule K, range 13c, because the partnership withdrew it is time offers put prior to their readiness. Comprehend the guidelines for Plan K, range 20c, to own conversion process or other dispositions out of property where a part 179 deduction has passed through to couples and for the recapture legislation if your organization utilization of the assets dropped to 50% or quicker. The partnership have to slow down the base of your own resource by quantity of the newest section 179 bills decided to go with from the union, whether or not a portion of one to amount cannot be passed as a result of in order to its people one year and may getting transmitted send as the from restrictions during the connection level. Don’t reduce the partnership’s basis inside the point 179 assets in order to reflect any part of the area 179 debts which is allocable to somebody which is a trust or home. Done Region I of Mode 4562 to figure the newest partnership’s part 179 expenses deduction.

Inside 19th and you may very early twentieth-century Central Africa, a familiar way for choosing if an individual try a great witch is to offer him or her poison; when they existed, they certainly were experienced simple, while you are their death might possibly be removed since the a sign of their shame. There are many different cases around the world in which confessions also have started extracted by applying torture. The brand new nineteenth-millennium owners of Dang repeatedly looked for to help you generate confessions by the suspending the brand new implicated witch upside down more a flames, a process one sometimes proved deadly.

Four Evening Battle Simulator Codes Upd dos.5 (Sep

Translate such numbers to the U.S. dollars with the appropriate rate of exchange (come across Bar. 514, Foreign Income tax Credit for folks). The connection have to report to their couples its express of any section 199A(g) deduction introduced because of regarding the cooperative, as the stated to the Function 1099-PATR. Part 199A(g) write-offs don’t need to end up being claimed on their own by the positions or businesses and certainly will getting claimed as the just one add up to lovers. The brand new unadjusted foundation from certified home is thought by adding the newest unadjusted basis of all of the certified property just after buy. Licensed assets has all tangible property subject to depreciation lower than point 167, where the brand new depreciable months hasn’t finished, that’s kept and you can used by the newest exchange otherwise business through the the new taxation seasons and you may kept to the past day of the new taxation year. The fresh depreciable months finishes on the after out of 10 years immediately after the house is placed in-service and/or past day’s the full 12 months to your appropriate data recovery months less than part 168.

To possess income tax years birth immediately after 2017, a business taxpayer, outlined before, is follow or alter its form of accounting not to cash in will cost you lower than part 263A. The expense expected to getting capitalized under area 263A aren’t deductible until the assets to which the costs connect comes, used, or else disposed of because of the partnership. If your connection has a payment of products marketed deduction, complete and you may attach Setting 1125-An excellent. Go into for the Mode 1065, web page step 1,range dos, the quantity away from Mode 1125-A good, range 8. Partnerships one qualify to make use of the new nonaccrual-feel approach (discussed before) is always to mount a statement proving total gross receipts, the amount perhaps not accumulated as a result of the applying of area 448(d)(5), plus the online matter accumulated.